Key Points

- Goldman Sachs said that it plans to spend $750 billion over the next decade financing and advising companies focused on sustainable finance themes such as climate transition and inclusive growth.

- “There are large opportunities. There are large markets. When we see that, we see need, and we see opportunity,” John Goldstein, who heads Goldman Sachs’ sustainable finance group, said Thursday on CNBC’s “Squawk on the Street.”

- ESG investing — or strategies that take a company’s environmental, social and governance factors into consideration — now accounts for more than $30 trillion worldwide in assets under management.

- “There is so much ideological, almost philosophical, baggage that needs to get stripped away to get to the investing question … Sometimes this field has too many adjectives, not enough nouns and verbs,” Goldstein said.

Goldman Sachs is making a big push into sustainable finance not because it makes sense from an ideological standpoint, but because it makes sense from a business perspective.

As themes relating to climate transition and inclusive growth play out, the firm sees big potential ahead.

“There are large opportunities. There are large markets. When we see that, we see need, and we see opportunity,” John Goldstein, who heads Goldman Sachs’ sustainable finance group, said Thursday on CNBC’s “Squawk on the Street.” “This is a large and accelerating trend. What do you do when you see that? You invest. You build your capabilities.”

On Sunday, Goldman Sachs said that it plans to spend $750 billion over the next decade investing in, financing and advising companies in areas related to nine key themes within climate transition and inclusive growth finance, which includes areas such as sustainable transport, accessible and affordable education and food production.

Goldstein said that the bank was already involved in these areas, but that the $750 billion gives the initiative “recognition,” while signalling to clients that this is a top priority across the firm. He pointed to high-growth sectors such as renewable power and electric vehicles as examples of areas where Goldman can help its clients transition their business plans.

In an opinion piece published Sunday in the Financial Times, the bank’s CEO David Solomon said that there is “not only an urgent need to act, but also a powerful business and investing case to do so.”

“Focusing on these specific goals gives us a set of metrics — such as the amount of carbon reduction and the number of people served — that we can track over time both for the companies and for ourselves,” he added.

The bank also overhauled its environmental policy framework, which includes stricter fossil fuel-related lending policies and a pledge that the firm won’t finance any new drilling projects in the Arctic.

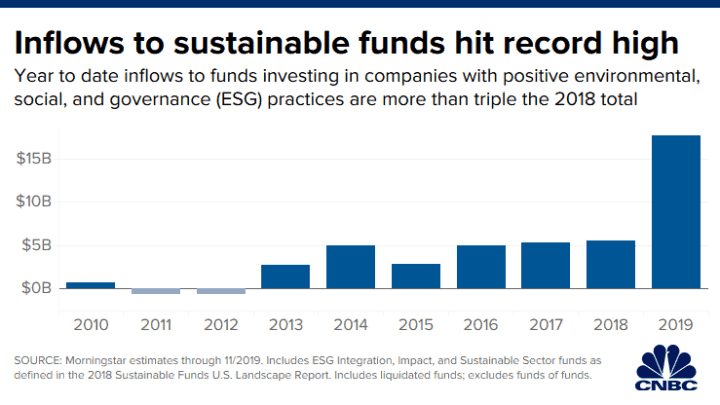

Goldman’s announcement comes as ESG investing, or strategies that focus on a company’s environmental, social and governance factors, has surged in popularity.

A record $17.76 billion has flowed into sustainable-focused ETF and open-end funds this year through the end of November, according to data from Morningstar, more than tripling last year’s $5.5 billion. And total worldwide assets under management within an ESG umbrella have now topped $30 trillion, according to Global Sustainable Investment Alliance.

There are a number of reasons for this surge, including millennial and generation Z investors taking a greater interest in the types of companies they support. But Goldstein said that it’s not just a shift in investor behavior, but rather a larger and broader societal shift.

“People whose preferences matter in the real economy want this in a way that has teeth. … Millennials want to shop differently. They want to buy different kinds of products from different kinds of companies,” he said. He added that to attract top talent in a low unemployment world, companies need to demonstrate that “what [they] do has meaning, and that [they] do it in a purposeful way.”

He also cited investor initiatives, such as the Climate Action 100+, as well as governmental policies, especially in Europe, driving change. Pointing to the recent power cuts in California aimed at avoiding fires, Goldstein said that these issues are visible and top of mind in a way that they haven’t been before.

But as momentum builds behind ESG investing, so too do calls for greater clarity over what exactly a fund means when it says it has an ESG mandate. This is made all the more difficult by the subjective nature of what exactly “ESG” means. This is one of the reasons why SEC Commissioner Hester Peirce says the labels, and funds that purport to be investing along these lines, need some type of oversight.

“The notion that we can come together and we can get our regulator to focus on an amorphous set of qualities other than the long-term financial value of a corporation, I think we’re fooling ourselves,” she said Tuesday on “Squawk on the Street.”

One of the issues, according to Goldstein, is that people are approaching these issues from two very different standpoints. Some see it as simply a box that needs to be checked, while others are focusing on the “messy, hard investment reality,” and trying to figure out solutions for complex issues like climate change.

“There is so much ideological, almost philosophical baggage that needs to get stripped away to get to the investing question,” he said of ESG strategies. “Sometimes this field has too many adjectives, not enough nouns and verbs.”

“At the end of the day, it’s not about ‘E,’ versus ‘S,’ versus ‘G’…There are actual economic transmission levers that help you take this broad concept of ESG and make it matter,” he added.

Source: www.cnbc.com